For many business owners, securing adequate funding can be a significant hurdle. Traditional financing options, such as business loans and lines of credit, often come with stringent requirements, including extensive financial statements or substantial revenue, which can be difficult for startups or smaller companies to meet. This is where credit card stacking emerges as a powerful and increasingly popular strategy to access unsecured capital.

What is Credit Card Stacking?

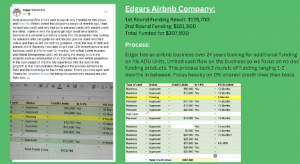

Credit card stacking is a funding strategy where businesses apply for multiple credit cards, often in a specific sequence, to secure a larger total unsecured line of credit than what a single card might offer. This method is particularly beneficial for businesses that don’t qualify for conventional loans due to a lack of established financials or revenue. A key advantage of this approach is the ability to obtain funding at a 0% interest rate, typically for an introductory period of 12 to 18 months.

How Does Credit Card Stacking Work?

The process of credit card stacking often involves working with a specialized firm that helps navigate the complexities of credit applications. Here’s a general breakdown of how it works:

- Credit Assessment: The stacking company reviews your personal credit scores, income, and other relevant qualifications to identify suitable credit cards. A personal credit score of 700 or above is typically required for most card approvals.

- Strategic Applications: Guided by the stacking experts, businesses apply for multiple credit cards, sometimes between 5 and 15 or more. These companies often have relationships with lenders that can help in requesting higher credit limits.

- Focus on Business Credit Cards: A significant emphasis is placed on business credit cards because, unlike personal credit cards, they generally do not appear on your personal credit reports if payments are made on time. This helps protect personal credit scores from high utilization.

- 0% Intro APR Offers: The strategy often targets cards offering a 0% introductory Annual Percentage Rate (APR) for an initial period, typically 6 to 18 months, which can significantly reduce interest costs.

- Accessing Funds: Once approved and cards are issued, they function as a business line of credit. Stacking firms can also provide guidance on how to convert these credit lines into cash without incurring cash advance fees.

The “Credit Line Hybrid” and Its Versatility

A variation known as the “Credit Line Hybrid” requires good personal credit or a credit partner with good credit. Like all credit card stacking, it’s unsecured, meaning no collateral is required. This financing is “no-doc,” requiring no down payment or income documentation, with approvals potentially reaching up to $150,000. The funds obtained through credit stacking can be utilized for a wide range of business needs, including:

- Real estate

- Equipment

- Working capital

- Startup expenses

Benefits of Credit Card Stacking

Credit card stacking offers several compelling advantages for business owners:

- Minimized Personal Credit Impact: By strategically submitting applications, stacking firms can help prevent an immediate negative impact on personal credit scores by applying for multiple cards simultaneously, delaying hard inquiries until after approval. Their expertise can also increase approval odds.

- Increased Rewards and Higher Limits: Businesses can leverage multiple credit cards to earn welcome bonuses, such as cash back, travel miles, or points. Additionally, business credit cards often offer higher limit approvals, potentially up to three times more than personal credit cards.

- Better Budgeting: Multiple cards allow for better tracking of spending by dedicating different cards to different types of purchases or projects.

- Increased Flexibility: Diversifying financing sources across multiple credit cards provides more flexibility and reduces the risk associated with relying on a single lender.

- Unsecured and Cost-Effective: The credit lines are unsecured, eliminating the need for collateral. The availability of 0% introductory APR offers makes it a cheap financing option for investors and business owners.

Tips for Successful Credit Card Stacking

To maximize the benefits of credit card stacking, entrepreneurs should adhere to these essential tips:

- Timely Payments: Always pay off balances on time to avoid fees that can negate any benefits.

- Separate Expenses: Keep personal and business expenses separate to simplify tracking for tax purposes.

- Direct Deposit for Payments: Utilize direct deposit for paying off balances to prevent missed payments due to mail delays or other issues.

When is Credit Card Stacking a Good Idea?

Credit card stacking is a viable option for business owners who may not qualify for traditional financing like SBA loans, business lines of credit, or working capital loans. It’s also suitable for small companies or low-revenue businesses that lack assets and are unable to secure conventional small business loans. This method offers quick access to funds, with approvals and card issuance often occurring within seven to ten business days.

Unsecured Funding Programs

Some programs specialize in securing unsecured business credit cards, with the ability to convert these into cash lines of credit at 0% interest for 12-18 months, effectively bypassing cash advance fees. These credit lines, available through major and regional banks, are designed to avoid impacting personal credit, require no collateral or equity sacrifices, and don’t involve complex financial statements or high-interest rates. Such programs can help members maximize credit limits to grow their businesses with substantial credit.

The funding process typically involves:

- Credit Optimization Plan: Evaluating personal and business credit profiles and making adjustments to position for maximum funding. This can include optimizing credit reports, removing negatives, or building banking relationships.

- Custom Funding Plan and Submission: An assigned account manager develops a customized funding plan based on the client’s credit and business profile, tailoring lender and product choices to suit their needs best. This may involve using “bureau stacking” to maximize funding and applying for pre-qualified offers.

By understanding the mechanics and benefits of credit card stacking, business owners can strategically unlock significant unsecured funding to fuel their growth and operational needs.